All Categories

Featured

Table of Contents

- – Accredited Investor Syndication Deals

- – Award-Winning Accredited Investor Syndication ...

- – Unparalleled Accredited Investor Investment R...

- – Personalized Private Placements For Accredite...

- – Exceptional Accredited Investor Platforms

- – Exclusive Accredited Investor Investment Net...

- – Premium Accredited Investor Investment Networks

If you're an investment specialist with a Collection 7, Collection 65 or Collection 82 or about to turn into one sometimes you're thought about a certified investor. Same if you go to the supervisor or above level of the business offering the safety and security, or if you're a knowledgeable staff member of a private fund that you would love to buy.

There are a variety of possibilities for recognized capitalists. The on the internet investing platform Yield Road, for instance, uses art, crypto, real estate, endeavor resources, temporary notes, lawful finance funds and various other specialized possession courses. Other platforms, AcreTrader and Percent, as an example, deal accessibility to farmland financial investments, seller cash loan and more.

Normally speaking, these types of chances aren't provided they originate from who you understand and what you're associated with. accredited investor wealth-building opportunities. For some, this could mean early rounds of start-up investing, bush funds or various other sorts of exclusive funds. Your financial investment advisor may also offer you specific economic tools or financial investments to think about if you're an accredited financier.

Remember, the intent behind avoiding retail capitalists from investing in unregistered safeties is to shield those who do not have the financial ways to stand up to huge losses.

Accredited Investor Syndication Deals

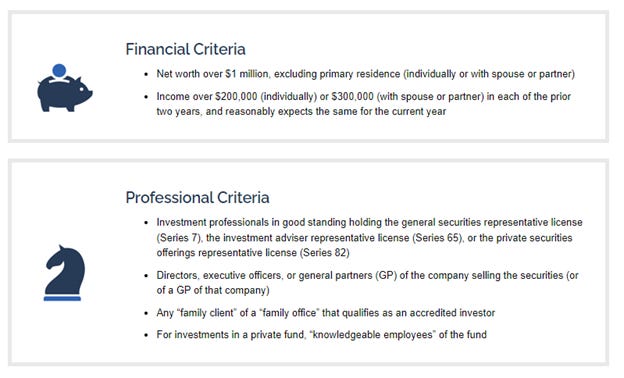

A private must have a web worth over $1 million, omitting the primary house (independently or with spouse or partner), to qualify as an accredited financier - accredited investor funding opportunities. Demonstrating sufficient education and learning or work experience, being a signed up broker or financial investment consultant, or having specific expert certifications can additionally certify a private as an approved investor

Recognized capitalists have accessibility to financial investments not signed up with the SEC and can consist of a "spousal matching" when identifying certification. Approved capitalists might encounter potential losses from riskier investments and must show monetary refinement to take part in unregulated financial investments. Accredited financier status matters because it identifies qualification for investment chances not available to the public, such as exclusive placements, endeavor capital, hedge funds, and angel investments.

To take part, accredited capitalists should approach the company of unregistered safeties, that might need them to complete a survey and supply financial documents, such as income tax return, W-2 kinds, and account statements, to validate their condition. Rules for certified financiers are supervised by the united state Securities and Exchange Payment (SEC), making sure that they satisfy particular monetary and professional standards.

Award-Winning Accredited Investor Syndication Deals

This development of the accredited financier swimming pool is meant to preserve financier protection while giving higher access to unregistered financial investments for those with the needed monetary sophistication and threat tolerance.

The contemporary age has opened the door to many certified investor chances that it can make you woozy. It's one point to generate income; it's quite one more keeping it and, without a doubt, doing what's required to make it expand. The arena has numerous verticals covering standard possession classes like equities, bonds, REITs and shared funds.

While these recognized financier investment opportunities are exciting, it can be tough to know where to get started. If you desire to recognize the ideal financial investments for certified financiers, you're in the ideal area.

Unparalleled Accredited Investor Investment Returns for Accredited Investors

First, let's make certain we're on the same web page regarding what a certified financier is. You can qualify as a certified capitalist in one of two means: A) You have the ideal licensure a Collection 7, Series 65, or Series 82 FINRA permit. B) You satisfy the economic requirements.

Take a look at the Whether you're a recognized investor currently or simply intend to be informed for when you are, right here are the most effective approved capitalist investments to think about: Score: 8/10 Minimum to begin: $10,000 Equitybee deals certified capitalists the possibility to buy firms prior to they go public. This indicates you don't need to wait for a firm to IPO to come to be a stakeholder.

There are lots of prominent (yet still not public) business presently offered on Equitybee: Epic Gamings, Stripes, and Waymo, to name a couple of. As soon as you've chosen a company, you can fund a staff member's supply options with the system. Simply like that, you're a stakeholder. investment platforms for accredited investors. Now, when a successful liquidity event happens, you're qualified to a percent of the profits.

The ability to gain accessibility to pre-IPO companies may be worth it for some financiers. The "one-stop-shop" element alone could make it one of the top recognized capitalists' financial investments, however there's even more to such as concerning the system.

Personalized Private Placements For Accredited Investors

(Resource: Yieldstreet) Ranking: 8/10 Minimum to get going: No reduced than $10,000; most possibilities vary in between $15K and $40K Rich financiers regularly turn to farmland to expand and construct their portfolios. Why? Well, consider this: In between 1992-2020, farmland returned 11% yearly, and only seasoned 6.9% volatility of return. And also, it has a lower connection to the stock exchange than a lot of alternative assets.

However you can still take advantage of farmland's land recognition and possible rental revenue by buying a platform like AcreTrader. (Resource: AcreTrader) AcreTrader is just offered to certified investors. The system supplies fractional farmland investing, so you can spend at a reduced rate than buying the land outright. Below's what's excellent regarding the platform: AcreTrader does the hefty lifting for you.

Exceptional Accredited Investor Platforms

That means you can rest easy with the reality that they have actually done their due persistance. And also, they do all the admin and outside administration. In terms of exactly how you make money, AcreTrader disburses yearly income to capitalists. According to their site, this has actually traditionally produced 3-5% for lower-risk financial investments. There's a possibility for greater returns over the previous 20 years, U.S.

Exclusive Accredited Investor Investment Networks

It's not hard to tough why. Let's begin with the money. As of February 2024, CrowdStreet has actually funded over 787 deals, a total amount of $4.3 billion invested. They flaunt a 16.7% realized IRR and an average hold period of 3.1 years. (Source: CrowdStreet) Next off up, the projects. Once you have actually given evidence of certification and established your account, you'll gain accessibility to the Market, which features both equity and financial obligation financial investment chances which may be multifamily homes or retail, workplace, or even land possibilities.

On Percent, you can also invest in the Percent Mixed Note, or a fund of various credit offerings. It's a simple means to diversify, yet it does have higher minimums than a few of the various other opportunities on the platform. Incidentally, the minimum for a lot of opportunities on Percent is rather tiny for this listing simply $500.

Premium Accredited Investor Investment Networks

You can both purchase the primary market and trade on the second market with other art capitalists. And also, Masterworks deals with the acquisition, storage space, insurance, and sales of the artwork. If it sells for a revenue, the proceeds are dispersed among financiers. While Masterworks is not simply for recognized financiers, there is a waitlist click listed below to check out much more.

Table of Contents

- – Accredited Investor Syndication Deals

- – Award-Winning Accredited Investor Syndication ...

- – Unparalleled Accredited Investor Investment R...

- – Personalized Private Placements For Accredite...

- – Exceptional Accredited Investor Platforms

- – Exclusive Accredited Investor Investment Net...

- – Premium Accredited Investor Investment Networks

Latest Posts

Investee Definition

High-Yield Bob Diamond Tax Sale Overages Education Overages List By County

Accredited Investor Philippines

More

Latest Posts

Investee Definition

High-Yield Bob Diamond Tax Sale Overages Education Overages List By County

Accredited Investor Philippines